Please, watch this YouTube video:

This You Tube video is very interesting, too:

This YouTube video explains the problem, very well:

Please, visit this Facebook page.

This YouTube video provides you a different angle to look at this issue:

Regardless of your take on it, there shouldn’t be any doubt that the so called stimulus and rescue packages, otherwise known as

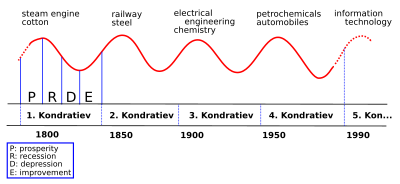

Please, refer to the Wikipedia article “Kondratiev wave“. It states:

“Kondratiev waves (also called supercycles, great surges, long waves, K-waves or the long economic cycle) are described as sinusoidal-like cycles in the modern capitalist

“Economic Waves series

Cycle/Wave Name Years

Kitchin inventory 3–5

Juglar fixed investment 7–11

Kuznets infrastructural investment 15–25

Kondratiev wave 45–60”.

“The Russian economist Nikolai Kondratiev (also written Kondratieff) was the first to bring these observations to international attention in his book The Major Economic Cycles (1925) alongside other works written in the same decade.”

“Kondratiev was a Russian economist, but his economic conclusions were disliked by the Soviet leadership and upon their release he was quickly dismissed from his post as director of the Institute for the Study of Business Activity in the Soviet Union in 1928.”

“Later, in Business Cycles (1939), Joseph Schumpeter suggested naming the cycles “Kondratieff waves”, in honor of the economist who first noticed them.”

“Korotayev et al. recently employed spectral analysis and claimed that it confirmed the presence of Kondratiev waves in the world GDP dynamics at an acceptable level of statistical significance.”

“Kondratiev identified three phases in the cycle: expansion, stagnation, recession.”

“1790–1849 with a turning point in 1815.

1850–1896 with a turning point in 1873.

Kondratiev supposed that, in 1896, a new cycle had started.”

“The saturation of major markets or infrastructures (canals, railroads) creates a stagnation in the economy.”

“The last two long cycles, which were both 53 years, can be better seen in international production data than in individual national economies.”

“The long cycle supposedly affects all sectors of an economy, and concerns mainly output rather than prices (although Kondratieff had made observations focusing more on prices, inflation and interest rates).”

“Deflation sometimes occurred during the cycle’s downturns under the gold standard; however, there is no strong historical correlation between depressions and deflation.”

“Over time the number of innovations in each wave increased and the diffusion of innovations overlapped, thus complicating dating the waves.”

“With lack of major technological driving forces and high debt levels, as in developed economies today, we should expect stagnation.”

“The phases of Kondratiev’s waves also carry with them social shifts and changes in the public mood.”

“Some scholars, particularly Immanuel Wallerstein, argue that cycles of global war are tied to capitalist long waves and major, highly-destructive wars, which tend to begin just prior to an output upswing.”

“David Ames Wells (1891) noted that as workers were lifted out of miserable levels of poverty by the end of the 19th century and exposed to a wider world view and new consumer products, they created more labor and social unrest.”

“Investment adviser Ian Gordon has advocated a 4 season Kondratiev social mood influenced model in which spring is moderate growth from a stock market and inflationary bottom, summer is characterized by accelerating growth and high inflation, autumn is characterized by declining inflation and asset bubbles, and winter involves the collapse of the asset bubbles.”

“Early on, several schools of thought emerged as to why capitalist economies have these long waves.”

“Since the inception of the theories, various studies have expanded the range of possible cycles, finding longer or shorter cycles in the data.”

“According to the innovation theory, these waves arise from the bunching of basic innovations that launch technological revolutions that in turn create leading industrial or commercial sectors.”

“Carlota Perez (2002) places the phases on a logistic or S curve, with the following labels: beginning of a technological era as irruption, the ascent as frenzy, the rapid build out as synergy and the completion as maturity.”

“Excessive debt is known to ultimately have negative consequences for the economy, although monetary policy, such as low interest rates, is used to increase borrowing and stimulate growth.”

“The link between depressions and debt was investigated by Irving Fisher during the Great Depression in Booms and Depressions.”

“In the U.S. since the beginning of the 20th century there were parts of two long term cycles of total debt relative to GDP. The first cycle had debt rising until the 1929 crash, after which the total debt-to-GDP spiked to about 260% during the Great Depression.”

“Economist Melchior Palyi (1892–1970) popularized the concept of marginal productivity of debt, which it came to be called after his death.”

“Because real estate is the collateral a large amount of private debt, Georgism, a philosophy that advocats government ownership of part of the economic rent value of land, views land price cycles as part of the credit cycle.”

“Because people have fairly typical spending patterns through their life cycle, such as schooling, marriage, first car purchase, first home purchase, upgrade home purchase, maximum earnings period, maximum retirement savings and retirement, demographic anomalies such as baby booms and busts exert a rather predictable influence on the economy over a long time period.”

Conquer the web with ExcitingAds!

Browse our Blog

Read our articles Global Recession: Causes, Consequences, Fixes, Part 3 and Global Recession: Causes, Consequences, Fixes, Part 5

Montana Shop

Howdy very nice site!! Guy .. Excellent .. Wonderful .. I’ll bookmark your blog and take the feeds additionally?I am satisfied to search out a lot of helpful info here within the put up, we’d like work out extra strategies in this regard, thanks for sharing. . . . . .

My brother recommended I might like this blog. He was entirely right. This post actually made my day. You cann’t believe simply how so much time I had spent for this info! Thank you!

Just desire to say your article is as surprising. The clarity for your submit is simply nice and i could suppose you’re a professional on this subject. Well with your permission allow me to snatch your RSS feed to keep up to date with coming near near post. Thank you a million and please keep up the gratifying work.